An old network security company has built itself into a proper tech giant.

It’s been a volatile 2024 for cybersecurity pure-play leader Palo Alto Networks (PANW 0.59%). Some bumps in the road and investor worries over an aggressive go-to-market strategy have made the stock’s recent performance a bit lackluster.

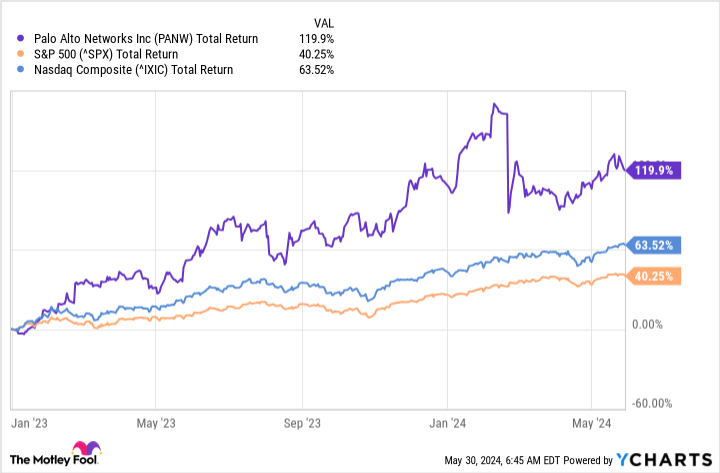

But zoom out to the start of 2023, and Palo Alto’s shares are up nearly 120%, crushing S&P 500 and Nasdaq Composite returns as the new bull market gets rolling.

Data by YCharts.

Overall enterprise software spending has continued the slowdown it experienced in 2023. For Palo Alto Networks, though, one metric might be indicating things are about to heat up again. Is it time to buy?

It’s time to drop a noisy financial metric

The cybersecurity space is intensely competitive with seemingly innumerable software start-ups that popped up during the cloud computing revolution of the last decade. But while the security hardware and services industry favors this kind of competition (it keeps much-needed innovation moving forward, a win for business customers), the industry is moving toward “platformization.” In other words, there’s too much competition, a lot of smaller vendors are financially broken, and consolidation of the field is needed.

Palo Alto Networks has turned into something of a platform since CEO Nikesh Arora took over in 2018. Businesses can now get multiple products and services in one single place. And while this always spurs concerns about security quality, the company is a technological leader in many key product categories like secure access service edge (SASE), which combines multiple network and cloud security services into one package.

For its fiscal 2024 third quarter (the period ended in April), Palo Alto Networks beat its own expectations for revenue growth with a 15% year-over-year increase to $2 billion. This was in spite of what has become a noisy billings metric (up only 3% from a year ago this last quarter), which measures the value of invoices sent to customers.

For many young software companies, billings are an important indicator of near-term growth. But Palo Alto’s business isn’t all that young anymore, and its wide and deep platform of services isn’t billed in simple terms. Customer deals are often multiyear, making the billings number a less useful metric than in the past.

For what it’s worth, billings were projected to rebound nicely, up 9% to 10% in the fiscal fourth quarter (which ends in July). This is good news, especially as Arora and company had discussed three months prior an aggressive go-to-market strategy to try to squeeze out smaller competition and get more customer needs migrated over to Palo Alto. This could be an early indicator that the plan is working.

How expensive is the stock really?

I fully expect billings to continue to be a less meaningful metric, while good old-fashioned revenue, earnings per share (under generally accepted accounting principles, or GAAP), and free cash flow (FCF) to take over. But based on these metrics, this is no cheap stock. Shares trade for 45 times trailing-12-month GAAP earnings, and 36 times FCF.

Is that a good deal? I believe it’s reasonable, though maybe not screaming “cheap.” This kind of valuation actually makes some sense assuming the company can keep growing revenue by low-teens percentages with some profit margin expansion and perhaps some shareholder returns through share buybacks. That assumes you have a long-term mindset and are willing to ride out the volatility for at least a few years.

The more years, the better, though. This stock has absolutely clobbered market and cybersecurity industry returns since Arora took the reins six years ago. It has the makings of a market beater in the future, too. I’m happy to keep holding on to my position after the latest quarterly update.

Nicholas Rossolillo and his clients have positions in Palo Alto Networks. The Motley Fool has positions in and recommends Palo Alto Networks. The Motley Fool has a disclosure policy.

This post was originally published on the 3rd party site mentioned in the title of this this site